Member's Corner

Energy Expert Lonnie Barish Says

Companies Continue to Squander Money on Utility Bills

A Simple Audit Can Save Companies a Small Fortune

As a seasoned project developer and construction manager of real estate development on behalf of several publicly traded institutions and private developers throughout the United States, he has used his passion to save his customers a small fortune.

Barish faced the constant challenge of finding ways to determine the best available energy saving options for his clients without having to navigate the maze of electricity and natural gas deregulation.

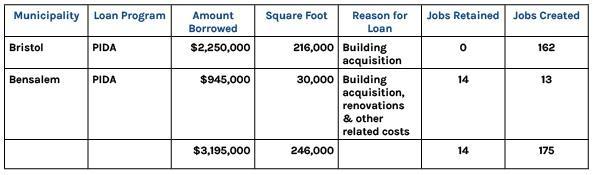

The Bucks County Economic Development Corporation (BCEDC) has a new partner in offering tax free financing to manufacturing companies, tax exempt projects, and 501C3 entities. The new partner is the Quakertown Area Commercial and Industrial Development Authority (QACIDA).

The Bucks County Economic Development Corporation (BCEDC) has a new partner in offering tax free financing to manufacturing companies, tax exempt projects, and 501C3 entities. The new partner is the Quakertown Area Commercial and Industrial Development Authority (QACIDA).