Last Chance to Register for this FREE Webinar – How Facebook Will Enhance Your Small Business May 6, 2020, 12:30 p.m. During these challenging times, small businesses are concerned about their viability when "normal" returns. One of the activities that you should do now is maximize your digital marketing efforts. Facebook offers a variety of tools for your business. In this webinar you will learn: What tools are availableHow to use the tools to increase salesHow Facebook compares with other digital choices This is a FREE 90-minute webinar! REGISTER NOW

| 215-348-9031 | 115 WEST COURT STREET | 2ND FLOOR | DOYLESTOWN, PA 1890 |

U.S. Small Business Administration Administrator Jovita Carranza announced today that agricultural businesses are now eligible for SBA's Economic Injury Disaster Loan (EIDL) and EIDL Advance programs. SBA's EIDL portal will reopen today as a result of funding authorized by Congress through the Paycheck Protection Program and Healthcare Enhancement Act. The legislation, signed into law by the President one week ago, provided additional funding for farmers and ranchers and certain other agricultural businesses affected by the Coronavirus (COVID-19) pandemic. "For more than 30 years, SBA has been prohibited by law from providing disaster assistance to agricultural businesses; however, as a result of the unprecedented legislation enacted by ...

Congress is expected to release a second round of Paycheck Protection Program (PPP) funds soon. In anticipation of the new funding round, Reinvestment Fund is sharing information on how you can prepare to submit an application. With this round of funding, Reinvestment Fund will be processing PPP applications. Reinvestment Fund's PPP program will focus on supporting small businesses and nonprofits that are aligned with their mission-driven financing. They will provide up to $25 million in total loans, with a maximum of $200,000 per loan. Through their PPP program, they hope to serve communities in their primary geographic footprint that are overlooked by mainstream markets. Click here for more on the focus of their&n...

The COVID-19 global pandemic has affected nearly every facet of our lives in ways that many of us have never seen before. While it is first and foremost a health threat, the pandemic has caused an immeasurable impact to our economy, businesses, and jobs. In an effort to help us better understand how this crisis is affecting your organization and our region as a whole, we invite you to participate in this anonymous 5 minute COVID-19 Business Impact Survey. We will be sharing the results upon completion of the survey. We also plan to use the data gathered to shape the content we provide to you, to ensure that we are continuing to provide helpful information that addresses your needs through all stages of this pandemic. Survey deadline is Tues...

Chamber calls on executives and companies to marshal available resources, talent, and unique capabilities to help small businesses in any way they can. To combat the economic destruction threatening the survival of small businesses in every town across America, the U.S. Chamber of Commerce today launched the Save Small Business Initiative — a nationwide program to address small businesses' immediate needs, mitigate closures and job losses, and mobilize support for long-term recovery. The Save Small Business Initiative features a four-part campaign including financial aid, resources and guidance, advocacy, and polling, as well as a call to action for the larger business community and government to help small businesses "Our nation is facing ...

BCEDC brings you this news, however, these loans were not associated with our organization.

"The SBA is currently unable to accept new applications for the Paycheck Protection Program based on available appropriations funding. Similarly, we are unable to enroll new PPP lenders at this time."

Today, Department of Community and Economic Development (DCED) Secretary Dennis Davin announced the forbearance of loans administered by DCED. "This pandemic has presented new and unforeseen challenges to Pennsylvania's businesses, and the Wolf Administration has been committed to supporting our business community to the fullest extent every step of the way," said Sec. Davin. "This extended deferral will help ease the burden on small businesses and enable them to focus and prioritize their efforts as we work to mitigate the spread of COVID-19 in the commonwealth." Next week, Governor Tom Wolf and Sec. Davin will request loan deferrals for all borrowers with the Ben Franklin Technology Development Authority, the Commonwealth Financing Author...

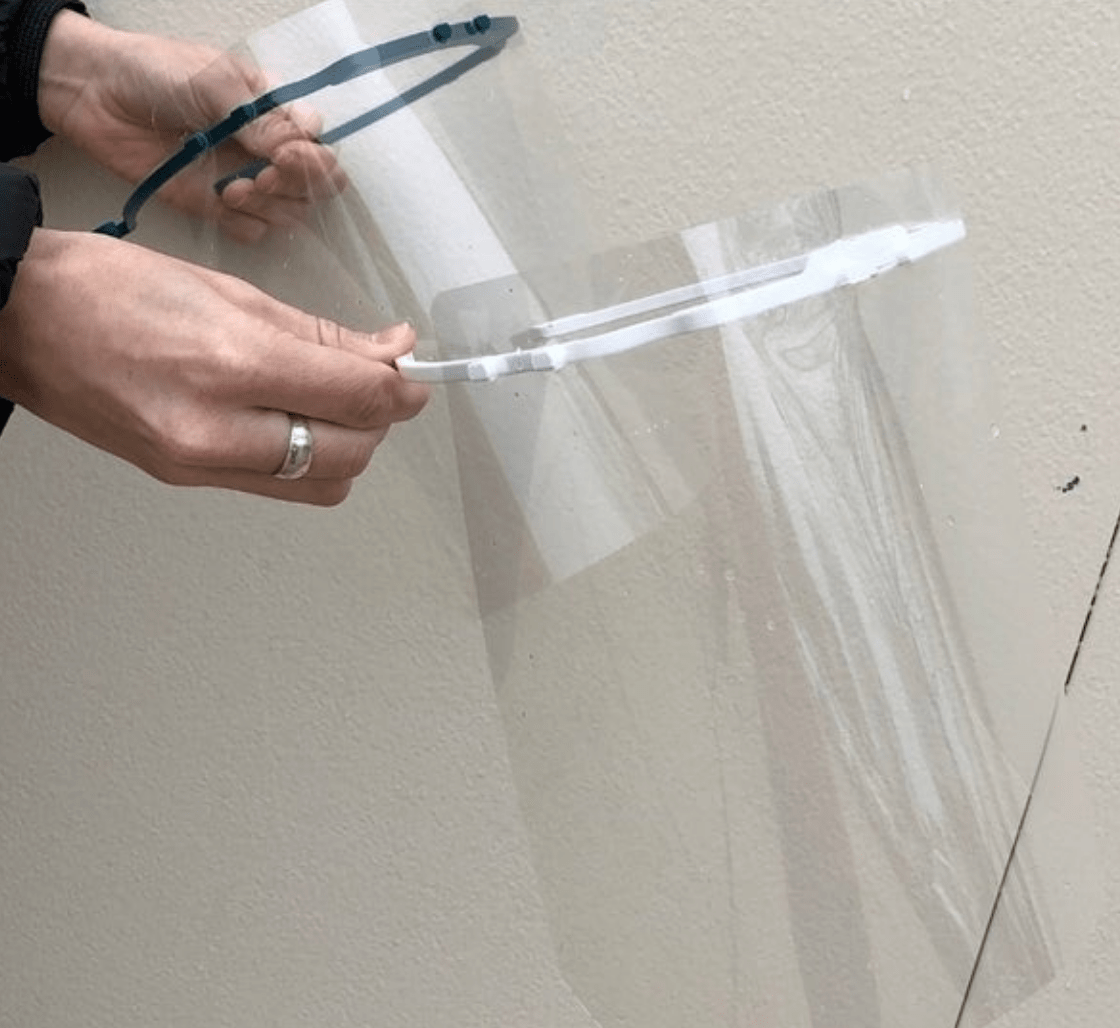

The Bucks County Intermediate Unit is using its seven 3D printers and laser cutter to help in the fight against COVID-19. At most times, the Bucks County Intermediate Unit is busy delivering educational programs from school to school. Now, with schools shut down due to the new coronavirus, the agency has a new focus — making personal protection equipment for those fighting the virus.Lindsey Sides, the intermediate unit's supervisor of STEAM (Science, Technology, Engineering, Art and Math), learned that some 3D printers were being used to make masks and other equipment for medical workers and first responders. She started investigating and, ultimately, got intouch with a professor at Cornell University who had mobilized a team that used 3D p...

Governor Tom Wolf today urged Pennsylvania manufacturers that currently are producing or can pivot to producing COVID-19-related supplies to submit their information to the newly developed Pennsylvania Manufacturing Call to Action Portal. "We're asking everyone to do their part to mitigate the spread of COVID-19, including ensuring that our health care system is prepared to care for patients and that there is access to critical personal protective equipment and products as more individuals and businesses take preventive measures," Wolf said. "Throughout our commonwealth's history, our manufacturing sector has answered the call to move us forward and contributed tremendously in times of turbulence. I call upon our private sector to be a part...

The SBA and Treasury Department have launched the new Paycheck Protection Program to help keep employees on payroll and small businesses operating. PLEASE NOTE WE ARE SHARING THE INFORMATION WITH YOU BUT BCEDC cannot administer the program, please contact your bank. PAYCHECK PROTECTION PROGRAM (PPP) INFORMATION FOR BORROWERS The Paycheck Protection Program ("PPP") authorizes up to $349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. All loan terms will be the same for everyone. The loan amounts will be forgiven as long as: The loan proceeds are used to cover payroll costs, and most mortgage interest, rent, and utility costs over the 8 week period after the loan is made; and Employee an...

The spread of the COVID-19 virus continues to present new challenges for our communities, businesses, and Pennsylvania's economy. Governor Wolf has taken action to protect the public and businesses in order to slow the spread of the virus. On March 19, Gov. Wolf issued an order to close all non-life sustaining businesses. The complete list of non-life sustaining businesses is found on our website along with frequently asked questions for all life-sustaining businesses. Businesses that were ordered to close under this order and believe that they could help mitigate the COVID-19 crisis or provide essential services, have until Friday, April 3, 2020 at 5PM to apply for a Business Exemption Waiver. After that time...

We received additional clarification from the Department of Community and Economic Development (DCED) regarding businesses who are waiting for their waivers to be approved. If your business has submitted a waiver and has not received a response, please DO NOT resubmit a waiver. DCED is working quickly to process 25,000 waivers at this time and will respond to your waiver as soon as possible. Please see this link for a revised FAQ listing on submissions. If your business receives conflicting information from DCED on whether or not your business is essential, please contact my office at 215-541-2388. Those businesses requesting clarification on whether they are defined as life-sustaining should check this list, email the Department of Communi...

Information on Governor's Order Recent Order Pertaining to Life-Sustaining Businesses. Businesses are encouraged to direct any general questions they may have about their business and this order, by emailing ra-dcedcs@pa.gov The Administration has set up a waiver process. If you have a company that believes they should be considered a life-sustaining-business and would like to apply for a waiver, please send an email to one of the following: ra-dcedcs@pa.gov – resource account to send questions about whether businesses need to close RA-dcexemption@pa.gov – resource account if businesses want to apply for a waiver and want information on the process Also, there is additional information and & resources on the PA DCED website at www...

Bucks County Business Owners: Pennsylvania's disaster declaration has been approved by SBA and our small businesses and private non-profits are able to apply for an SBA Economic Injury Disaster Loan (EIDL) online at https://disasterloan.sba.gov/ela. Businesses should be prepared with the documentation needed to apply. For example, they will be asked for federal business and personal tax returns, and historical and projected revenue. All businesses are able to review the SBA Disaster Business Loan Application paper forms and requirements at https://disasterloan.sba.gov/ela/Information/PaperForms. A complete and thorough application will be eligible for funding (an incomplete application will delay the process.) The most up-to-date website on...

Economic Development Impact Survey The Southeast Region is conducting a Business Impact Study to determine how your business is affected during the COVID 19 situation.

Manning-MFG, LLC, through the Bucks County Economic Development Corporation (BCEDC), was approved for a $640,000 PIDA loan at a 3 percent fixed interest rate for 10 years for the acquisition of an existing 28,060 sq. ft. multi-occupancy building in Bristol Township. The facility is currently fully occupied with four longstanding tenants who will continue their agreement with Manning-MFG, LLC. The total project cost is $1.6 million.

The Pennsylvania Industrial Development Authority (PIDA) recently approved five new low-interest loans to businesses for expansion and job creation. The authority also provides low-interest loans and lines of credit to companies for the development of industrial parks and multi-tenant facilities. For applications received by March 31, interest rates will vary between 2 percent and 3 percent. "Access to low-interest capital is critical for small business growth," Gov. Tom Wolf said. "The commonwealth's partnership will provide the affordable capital needed to bolster expansion projects and job creation, without the burden of exorbitant interest rates." PIDA approved $52.9 million in low-interest loans last year, and so far, this year has app...

PIDA provides low-interest loans for businesses that commit to creating and retaining full-time jobs and for the development of industrial parks and multi-tenant facilities. Loan applications are packaged and underwritten by a network of certified economic development organizations (CEDOs) such as Bucks County Economic Development Corporation (BCEDC), that partner with PIDA to administer the loan program. The loan rate announced for the first quarter of 2020: PIDA-3% fixed for full term of loan; other options available. Equipment-3% fixed full term of loan Loan rates are valid for application submitted until 3/31/2020. Conact BCEDC, 215.348.9031 for information on how we may assist you to move your business i...

Bob Cormack will utilize his 42 plus years of experience in economic development to assist the Pennridge School Board. Bob and his family have resided in the district for over 30 years. Cormack has also served on the Upper Bucks County Technical School's Advisory Committee for 20 years, and was a member of the most recent Pennridge comprehensive planning committee. As a parent of three children who attended Pennridge K-12; one who was in the gifted program, one with special needs and a third who took the middle of the road classes, my wife and I got to experience a wide range of what Pennridge has to offer kids with all different interest and ability levels. I have no other intention but to serve the district in providing the...

PIDA (Pennsylvania Industrial Development Authority) interest rates are the lowest they have been all year. Rates are as low as 1.75% for Real Estate or Land and Machinery & Equipment 2.75% fixed. Why choose a PIDA loan? Many businesses are eligible for this type of loan. PIDA is not a substitute for conventional bank lending but works in conjunction with banks or other lenders to provide as much as 50% of the project cost to a maximum of $2,000,000. PIDA's below market interest rate is a major benefit for cash flow savings. To learn more about how the low interest rates can assist your business goals, Contact BCEDC, 215.348.9031