Growing Your International Business While Managing Global Risk

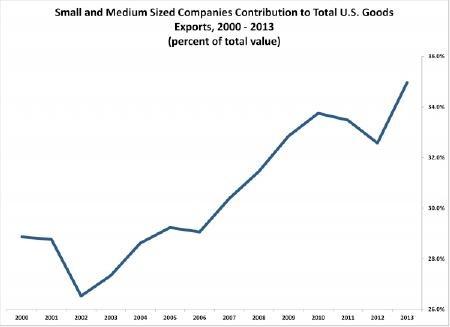

It’s been quoted numerous times, that 95 percent of the world’s consumers live outside of the United States. So, common sense would dictate that if U.S companies are selling domestically, these companies are limiting their sales potential. The good news is, according to the chart on the right (Published on Economics and Statistics Administration (www.esa.doc.gov) that exporters are getting the message.

Although these statistics are an encouraging sign, I’m often asked by aspiring exporters a seemingly easy question such as, “How do I get started?” I referred to that question as easy, but the fact is that this is a critical juncture for the new –to- trade person or company.

I’m sure we’ve all attended seminars and workshops with the good intentions of taking the “fear” out of exporting. However, often times these programs begin by pointing out the risks of exporting before getting into the benefits. I can speak to this, as early on in my career I was guilty of doing the same.

I’m sure we’ve all attended seminars and workshops with the good intentions of taking the “fear” out of exporting. However, often times these programs begin by pointing out the risks of exporting before getting into the benefits. I can speak to this, as early on in my career I was guilty of doing the same.

For the purpose of this newsletter, I’ve broken the process down to three basic stages. For some readers, this may appear to be an overly simplistic approach. However, it’s been my experience that these are the essential three steps in getting started.

The first step in getting your company started in global trade is to contact the U.S. Commercial Service - Philadelphia U.S. Export Assistance Center. They offer export and market entry counseling and work with their counterparts in the 127 U.S. Embassies and Consulates overseas to provide access to resources designed to assist businesses in their global sales efforts. Market entry services such the Gold Key Matching Service (GKS) provides an appointment schedule arranged before you travel overseas. The program pre-screens potential agents, distributors, sales representatives, etc. in your targeted export market. The International Partner Search (IPS) helps identify qualified international buyers, partners or agents without traveling overseas. Thus saving the new exporter time and expense. These are but two of the many programs that U.S. Exporter Assistance Center offers.

For more information, please contact the following:

Tony Ceballos Primary Industries: Education & Training, Travel & Tourism Director, Email: Antonio.Ceballos@trade.gov Phone: 215-597-7141

Sam Cerrato Primary Industries: Aerospace & Defense Technology,

Aircraft & Aircraft Parts, Sr. Trade Specialist Information & Communications , Electric Power, Safety & Security, Telecommunications, Email: Samuel.Cerrato@trade.gov Phone: 215-597-6120

Theo Hunte Primary Industries: Architecture, Construction & Engineering, Consumer Goods,Sr. Trade Specialist Industrial Chemicals & Equipment, Mining, Oil & Gas, Textiles & Apparel, Email: Theo.Hunte@trade.gov Phone: 215-597-6105

Iris Kapo Primary Industries: Automotive & Transportation, Coal, Drugs & Pharmaceuticals, Trade Specialist Healthcare Technology, Lab Instruments and Equipment, Veterinary Medicine, Email: Iris.Kapo@trade.gov Phone: 215-597-6127

Kennia Somerville Primary Industries: Agribusiness, E-commerce, Food & Food Processing, Machine Tools, Commercial Officer Non-ferrous Metals, Paper & Pulp, Printing, Plastics Materials , Renewable Energy Email: Kennia.Somerville@trade.gov Phone: 215-597-6128

Bob Elsas U.S. Small Business Administration - Credit Insurance and Trade Finance, Sr. Loan Officer, Email: Robert.Elsas@mail.doc.gov Phone: 215-597-6110

The second step is to find a freight forwarder who can manage your shipments and provide you with the expertise on compliance, documents, incoterms and industry specific information.

I’ve had one client comment that they interview potential freight forwarders as if they were potential employees of their company. A forwarder does not actually move the goods but acts as an expert in the logistics network. A forwarder contracts with carriers to move cargo. Freight can be booked on a variety of shipping providers, including ships, airplanes, trucks, and railroads. It is not unusual for a single shipment to move on multiple carrier types. International freight forwarders typically handle international shipments. International freight forwarders have additional expertise in preparing and processing customs and other documentation and performing activities pertaining to international shipments.

Information typically reviewed by a freight forwarder includes the commercial invoice, shipper’s export declaration, bill of lading and other documents required by the carrier or country of export, import, and/or transshipment. Much of this information is now processed in a paperless environment.

The third step is finding a bank that has the expertise in financing and processing your international trade transactions. For exporters that require working capital to either manufacture and/or source raw material, the SBA and The Export-Import Bank of the United States have programs that give banks the added assurance of securing or guaranteeing payment of working capital loans.

One such program is the Working Capital Program. This program guarantees 90% of the exporter’s working capital loan, thus allowing banks to increase their lending to a qualified exporter.

Trade Credit Insurance is another tool that’s available for exporters to mitigate the risk of offering open account terms to their overseas customers. This option delivers a dual benefit, as the exporter can offer their customer better terms. As the receivables are insured, the bank can be named as “loss payee” and now feel more comfortable lending against those now insured receivables.

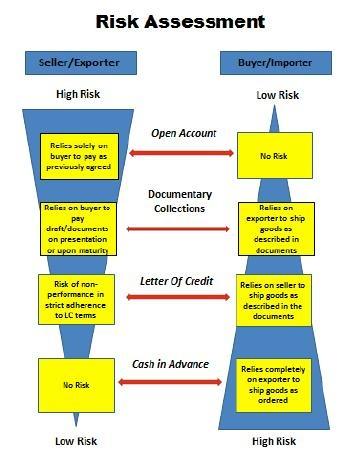

Understanding who bears the risk of each basic international payment method can best be illustrated on the following chart:

There is no single payment solution for engaging in international business. Client/country risk and competition for your product or service will influence which payment method is best.

Cash In Advance

The applicability for Cash In Advance is for high-risk trade relationships or export markets. Virtually no risk for the exporter, as the burden of risk in on the importer. The exporter receives payment before shipment; however, your competitors may be offering better terms causing you to lose business.

Open Account

Open Account terms may be the only way for the exporter to do business with certain customers in competitive markets. These terms may also be used in secure trading relationships. This method of payment is a competitive tool and can be the difference in winning/losing relationships. The risks of open account can typically be mitigated by insuring these buyers through the use of trade credit insurance.

Letters of Credit

While most exporters have had some level of experience with Letters of Credit, this method of payment offers both the importer and exporter the optimal level of risk mitigation. Involving your bank and freight forwarder early in the process will ensure a properly worded letter of credit and instrument by which payment will be expedited. Letters of credit are applicable with new or less established trade relationships, in which the exporter is satisfied with the creditworthiness of the importers’ bank. Risk is balanced between buyer and seller if all terms and conditions are adhered to. The letter of credit provides a wide variety of payment, financing and risk mitigation options. If not properly negotiated, they can be costly and labor intensive. However, as mentioned, getting your bank and freight forwarder involved early will virtually eliminate all of the negatives.

While most exporters have had some level of experience with Letters of Credit, this method of payment offers both the importer and exporter the optimal level of risk mitigation. Involving your bank and freight forwarder early in the process will ensure a properly worded letter of credit and instrument by which payment will be expedited. Letters of credit are applicable with new or less established trade relationships, in which the exporter is satisfied with the creditworthiness of the importers’ bank. Risk is balanced between buyer and seller if all terms and conditions are adhered to. The letter of credit provides a wide variety of payment, financing and risk mitigation options. If not properly negotiated, they can be costly and labor intensive. However, as mentioned, getting your bank and freight forwarder involved early will virtually eliminate all of the negatives.

Documentary Collections

Documentary collections are best used in established and stable markets and for ocean shipments. Ocean shipments under a bill of lading are title documents. Whoever is named on the bill of lading holds title (ownership) of the goods. Having the bills of lading consigned properly and in a manner that the exported is protected, ensures that the importer will not receive goods until paid. This is a low cost alternative to letters of credit as they do not carry the obligation of a bank. However, both the importer and exporter’s banks are involved and provide assistance in facilitating payments

Managing Foreign Exchange Risk

There is foreign exchange risk to someone in virtually every international transaction-even those payable in U.S. dollars. The four basic risks are:

- Fluctuation risk

- Transaction risk – cash flow risk

- Economic risk – operating risk vs. competitors

- Translation exposure-accounting risks

As an exporter, quoting in foreign currency to your overseas clients may increase your global sales, as the importer is bearing the risk of the US Dollar. If you choose to invoice in USD overseas, you continue to have FX risk, but indirectly as it manifests itself in how competitive your pricing is abroad, perhaps being detrimental to sales. Understanding and managing foreign exchange risk (direct and indirect) is a key component to your global business. First Niagara has the tools and expertise to help you mitigate foreign exchange through our competitive consultation services.

The International Trade Services Group of First Niagara Bank, N.A. is well positioned to help aspiring and established importers and exporters with a full complement of trade products and services. Whether you are a company or individual seeking working capital, or structing complex transactions, First Niagara can assist you in achieving global success.

In summary, the development of an international sales plan will always be a work in progress. However, once the basics are in place, you can rely upon you team of experts from the government, freight forwarder, trade organizations and your bank to help grow your business and mitigate global risk.

Written by First Niagara’s International trade specialist, Ralph Bocchino, Vice President, International Trade Services, Ralph.Bocchino@fnfg.com, 585-770-1673.