BCEDC Board Member, Jackie Fahey, Appointed Senior Vice President Market Leader Bucks County, Centric Bank

Centric Financial Corporation, (OTC: CFCX), the parent company of Centric Bank, has announced that Jacqueline (Jackie) M. Fahey has been appointed Senior Vice President, Market Leader Bucks County. Fahey will be responsible for growing the bank’s lending and deposit relationships, as well as gaining a greater penetration in this key strategic market for Centric Bank. A Bucks County native, Fahey is a passionate community champion with a proven track record of success in commercial lending, specifically commercial and industrial, commercial real estate, and small business lending.

“Jackie’s 15 years of experience in commercial banking and lending make her the perfect partner to lead our growth in Bucks County and expand our presence in Philadelphia,” says Patricia (Patti) A. Husic, President & CEO of Centric Bank and Centric Financial Corporation. “As a leader in organic loan growth in Pennsylvania, we appreciate the special connection and trust people feel with their community lenders. Our word and handshake are still two of the most powerful brand promises on the planet, and Jackie’s reputation as a strong, loyal business advocate enhances our culture.”

“Jackie’s 15 years of experience in commercial banking and lending make her the perfect partner to lead our growth in Bucks County and expand our presence in Philadelphia,” says Patricia (Patti) A. Husic, President & CEO of Centric Bank and Centric Financial Corporation. “As a leader in organic loan growth in Pennsylvania, we appreciate the special connection and trust people feel with their community lenders. Our word and handshake are still two of the most powerful brand promises on the planet, and Jackie’s reputation as a strong, loyal business advocate enhances our culture.”

“I am incredibly honored to join Patti Husic and Centric Bank as they expand in my hometown region. Our business lending services are financing tremendous growth for business owners, medical and dental practices, and the professional services sector,” says Fahey. “What attracted me to Centric Bank was their people. They provide the personal connection of a community bank but are powered by products, services, and technologies typical of much larger institutions. I am inspired by the impact Centric Bank is having on our clients, our partners, and our community, and I am thrilled to introduce new customers to the Centric Way of Banking.”

Most recently, Fahey served as regional vice president of commercial banking for Republic Bank in Bucks County. She holds a Bachelor of Science in Business from Thomas Jefferson University, Philadelphia, and serves on the Bucks County Economic Development Corporation Board of Directors and the YMCA of Doylestown Board.

The Bucks County team, located at 2003 S. Easton Road, Suite 205 in Doylestown, PA, provides concierge banking and commercial lending with a concentration on commercial and industrial (C&I), professional services sector financing, including medical and dental practices, and SBA financing. In addition, they provide cash management, remote deposit capture services, and 24/7 internet banking and mobile banking. The team’s experience in medical financing parallels the Doctor Centric Bank concierge banking services.

About Centric Financial Corporation and Centric Bank

An American Banker 2019 and 2018 Best Banks to Work For, three-time American Banker Most Powerful Women in Banking Top Team, three-time Best Places to Work, and Top 50 Fastest-Growing Companies for six years, Centric Bank is headquartered in south central Pennsylvania with assets of $790 million and remains a leader in organic loan growth. A locally owned, locally loaned community bank, Centric Bank provides highly competitive and pro-growth financial services to businesses, professionals, individuals, families, and the health care industry. Centric Bank is a Top 10 SBA 7(a) Lender in the Eastern District of Pennsylvania.

Founded in 2007, Pennsylvania-based Centric Bank has financial centers located in Harrisburg, Hershey, Mechanicsburg, Camp Hill, and Doylestown, loan production offices in Devon and Lancaster, and an Operations and Executive Office campus in Hampden Township, Cumberland County. A Devon Financial Center will open in January 2020. To learn more about Centric Bank, call 717.657.7727 or visit CentricBank.com. Connect with them on Twitter, Facebook, LinkedIn, and Instagram.

{autoreadmore}

Today, PPL Corporation is one of the largest companies in the U.S. utility sector. PPL Electric Utilities — one of the family of PPL companies — grew quickly after its founding as additional, smaller local power companies were acquired. Today, we serve 1.4 million customers in all or part of 29 Pennsylvania counties in a service territory with a land area larger than New Jersey.

Today, PPL Corporation is one of the largest companies in the U.S. utility sector. PPL Electric Utilities — one of the family of PPL companies — grew quickly after its founding as additional, smaller local power companies were acquired. Today, we serve 1.4 million customers in all or part of 29 Pennsylvania counties in a service territory with a land area larger than New Jersey. Line workers and engineers during the Great Depression, World War II and the turbulent 1960s would hardly recognize today’s technologically advanced smart grid that can automatically reroute power with the help of software and sensors. They’d surely be impressed with a system that can safely and automatically cut power to a downed power line. They’d probably even marvel about 3-D design and virtual reality, paying a bill by text message and more.

Line workers and engineers during the Great Depression, World War II and the turbulent 1960s would hardly recognize today’s technologically advanced smart grid that can automatically reroute power with the help of software and sensors. They’d surely be impressed with a system that can safely and automatically cut power to a downed power line. They’d probably even marvel about 3-D design and virtual reality, paying a bill by text message and more.

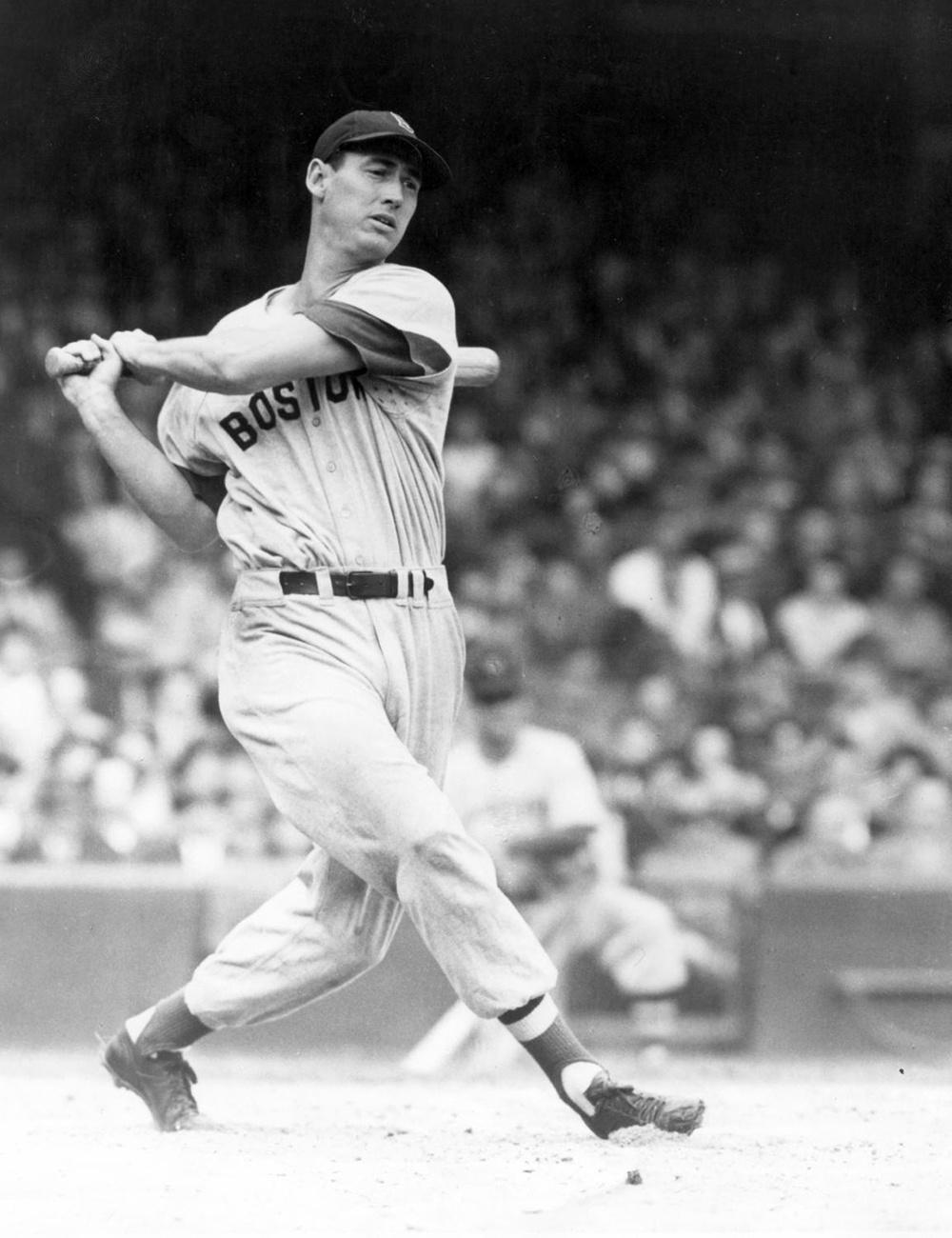

The essence of Williams' strategy was to break the strike zone down into a 7 x 11 grid and assign his probability of hitting the ball to each of the sections in the strike zone. He then used this "heat map" to determine what he called his "fat pitch"-the one that gave him an above-average chance of getting a hit.

The essence of Williams' strategy was to break the strike zone down into a 7 x 11 grid and assign his probability of hitting the ball to each of the sections in the strike zone. He then used this "heat map" to determine what he called his "fat pitch"-the one that gave him an above-average chance of getting a hit.

Ryan is a Council Rock graduate and former resident of Holland and Yardley and looks forward to building new relationships and growing existing ones.

Ryan is a Council Rock graduate and former resident of Holland and Yardley and looks forward to building new relationships and growing existing ones.

“After spending 25 years at our previous location, we are excited to ring in the New Year in this new office space,” stated Licht. “We look forward to continuing to serve our existing clients, welcoming new clients and rounding out our team with additional brokers,” he added.

“After spending 25 years at our previous location, we are excited to ring in the New Year in this new office space,” stated Licht. “We look forward to continuing to serve our existing clients, welcoming new clients and rounding out our team with additional brokers,” he added.

“Jackie’s 15 years of experience in commercial banking and lending make her the perfect partner to lead our growth in Bucks County and expand our presence in Philadelphia,” says Patricia (Patti) A. Husic, President & CEO of Centric Bank and Centric Financial Corporation. “As a leader in organic loan growth in Pennsylvania, we appreciate the special connection and trust people feel with their community lenders. Our word and handshake are still two of the most powerful brand promises on the planet, and Jackie’s reputation as a strong, loyal business advocate enhances our culture.”

“Jackie’s 15 years of experience in commercial banking and lending make her the perfect partner to lead our growth in Bucks County and expand our presence in Philadelphia,” says Patricia (Patti) A. Husic, President & CEO of Centric Bank and Centric Financial Corporation. “As a leader in organic loan growth in Pennsylvania, we appreciate the special connection and trust people feel with their community lenders. Our word and handshake are still two of the most powerful brand promises on the planet, and Jackie’s reputation as a strong, loyal business advocate enhances our culture.”