Pricing – The Most Misunderstood Element of Your Strategy

Pricing is one of the most controversial and difficult issues a company faces, and it is oftentimes the most misunderstood element of the organization’s strategy. The obvious issues with pricing pertain to your competitive position. Pricing often reflects your position in the market in terms of whether your competitive strategy is to be value-added or a commodity/low cost option.

There is another element to pricing that many companies overlook, which is how to tailor your pricing to specific customer groups based on how important they are to your company. Many companies have a standard pricing policy that they implement across the board with all customers. However, the best companies we work with have different pricing policies for their most profitable and least profitable customers. While that strategy is advisable, companies may hesitate to increase prices for certain customers for fear they will lose them. They may also cut their prices quickly due to competitive pressures without understanding the real consequences of doing so.

Most companies also don’t recognize the relationship between price changes and volume when making decisions. We believe that a smart pricing approach involves first answering these two fundamental questions:

- If we decrease prices, how much more revenue must we produce to make up for the lost margin from the price decrease?

- If we increase prices, how much revenue can we lose before we are any worse off?

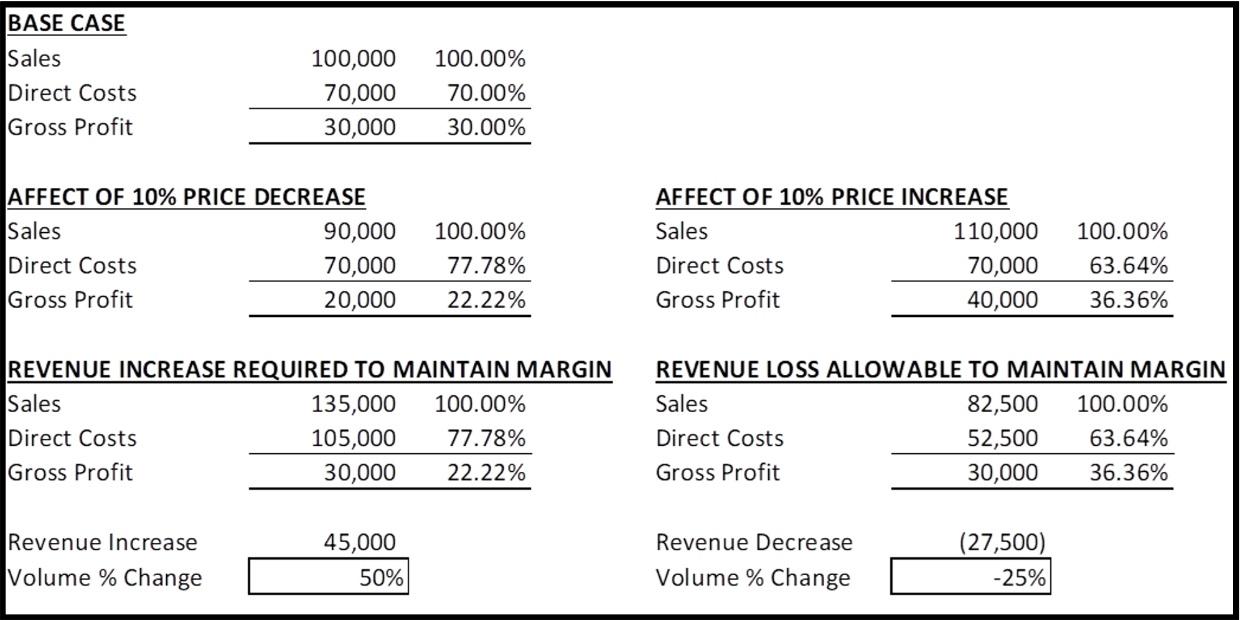

The answers to these questions depend on your company’s current gross margin, but the relationship between price and volume surprises most people when you unpack the data. For example, assuming a company has a 30 percent gross profit, if the company implements a price decrease of just 10 percent, it must increase revenue by 50 percent to make up for the lost margin dollars. However, if the company implements a 10 percent price increase, it can afford to lose 25 percent of its revenues before it is any worse off due the increase in margin.

When we explain this, many don’t believe the numbers. However, the illustration below proves that this methodology is correct.

Having a clear understanding of these price and volume relationships is critical to making better pricing decisions. Addressing pricing issues by considering the two fundamental questions above should provide your company with the tools to de-risk the decision of whether to increase or decrease prices.

Mario O. Vicari is a director and a specialist for the Center for Private Company Excellence. Contact him at Email.